5. Military expenditure and arms production

Overview, Diego Lopes da Silva

I. Global developments in military expenditure, 2022, Diego Lopes da Silva, Nan Tian, Lucie Béraud-Sudreau, Lorenzo Scarazzato and Xiao Liang

II. Regional developments in military expenditure, 2022, Nan Tian, Xiao Liang, Lucie Béraud-Sudreau, Diego Lopes da Silva, Lorenzo Scarazzato and Ana Carolina de Oliveira Assis

III. Arms-producing and military services companies, 2021, Xiao Liang, Ana Carolina de Oliveira Assis, Anastasia Cucino, Madison Lipson and Sanem Topal

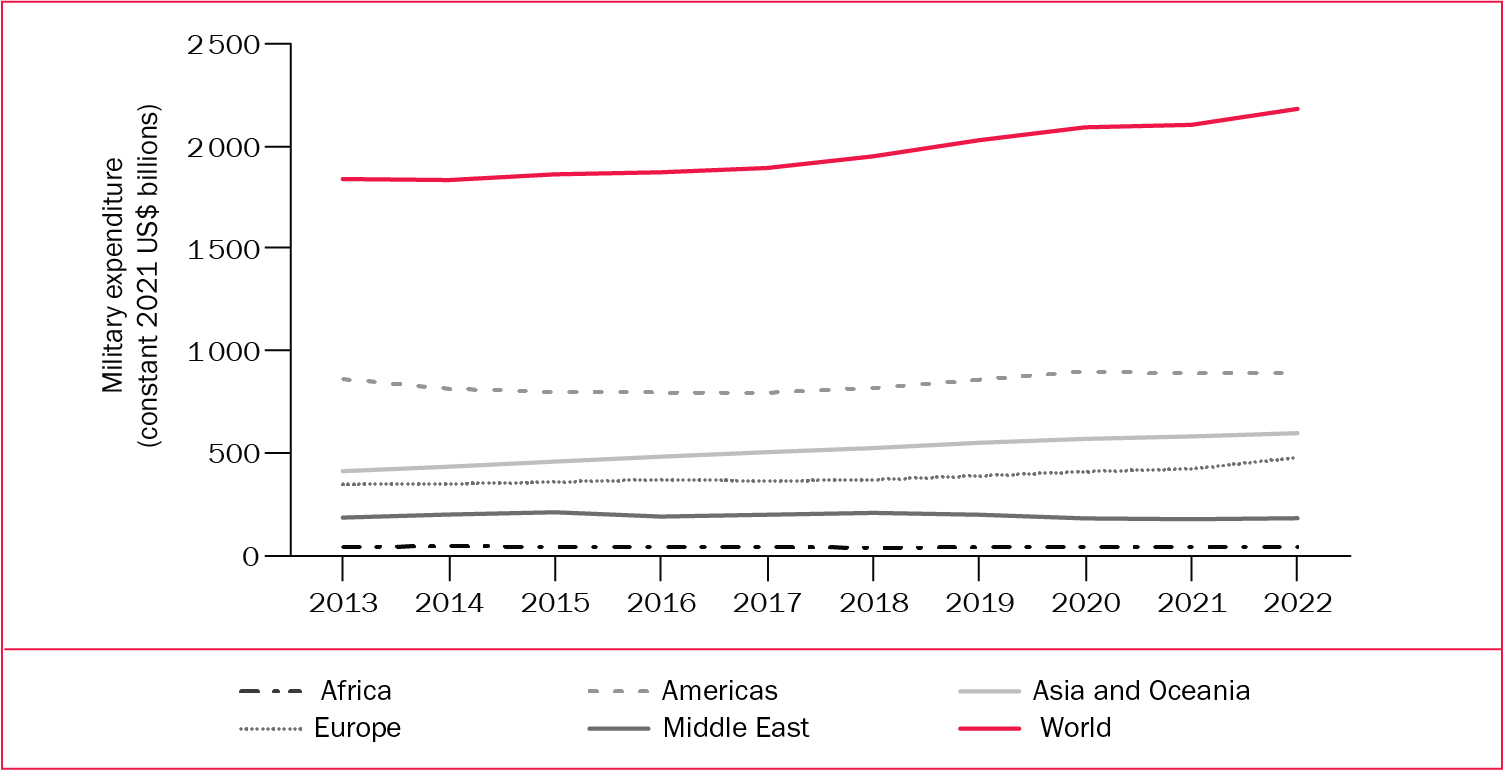

Global military expenditure rose for the eighth consecutive year in 2022 to reach an estimated $2240 billion, the highest level ever recorded by SIPRI. Despite the 3.7 per cent year-on-year increase in spending, world military expenditure as a share of world gross domestic product (GDP)—the military burden—remained at 2.2 per cent because the global economy also grew in 2022. Governments around the world spent an average of 6.2 per cent of their budgets on the military, or $282 per person.

Impact of the Russia–Ukraine war

The war in Ukraine had a major effect on both global and regional military expenditure in 2022. Military expenditure in Europe grew by 13 per cent, with most Central and West European countries—some of which were already among the largest military spenders in the world—responding to the invasion with significant increases in military spending. They also made plans for future growth, with some increases stretching until 2033. This suggests that the war, and the ensuing rise in European military spending, will exacerbate the ongoing upward trend in global military expenditure. Most of these allocations are for modernizing military equipment and increasing troop numbers. Germany, for example, plans to make additional efforts to spend 2.0 per cent of its GDP on the military.

Military aid for Ukraine was another cause of the increase in military expenditure in Central and Western Europe and North America: most countries in these sub-regions either sent financial military aid to Ukraine or spent more to replenish dwindling stockpiles after sending military equipment. Ukraine’s own military spending rose more than seven-fold, amounting to over one third of the country’s economy. Russian military spending also increased, by 9.2 per cent, despite economic sanctions from Western countries.

Other regional spending patterns

Estimated military spending in the Middle East rose for the first time in four years, by 3.2 per cent. Saudi Arabia is the region’s largest military spender, and its 16 per cent increase was the main reason for the regional increase. In Israel, the second largest spender in the Middle East, military spending fell by 4.2 per cent.

Spending in Asia and Oceania rose by 2.7 per cent in 2022. China’s ongoing military modernization and increased spending by India and Japan have been major factors pushing up military spending in the region. Japan’s military burden surpassed 1.0 per cent for the third consecutive year and was at its highest level since 1960. Moreover, the government announced plans to increase its total security spending to 2.0 per cent of GDP by 2027. The shift in Japanese security policy is a result of growing regional tensions, especially with China and North Korea. Military spending by China, the world’s second largest spender, rose for the 28th consecutive year, by 4.2 per cent. This narrowed the gap between its spending and that of the United States.

While the USA remained by far the largest military spender in the world, exceptionally high levels of inflation transformed a nominal increase in military spending of 8.8 per cent into a 0.7 per cent real-terms increase. As a consequence, overall military spending in the Americas rose only slightly, by 0.3 per cent.

The only region in which military spending fell was Africa, down by 5.3 per cent. This was the region’s first decrease since 2018 and its largest since 2003. Poor economic performance and natural disasters in the region’s largest spenders led to the fall in military spending despite ongoing security challenges.

Military expenditure by region, 2013–22

The SIPRI Top 100

The arms sales of the 100 largest arms-producing and military services companies (the SIPRI Top 100) totalled $592 billion in 2021 (the most recent year for which data is available), 1.9 per cent higher than in 2020 and continuing an upward trend since at least 2015. This growth came despite the continuing effects of the pandemic, most notably the disruption in supply chains, labour shortages and a lack of semiconductors. The USA continued to dominate the ranking with 40 companies with total arms sales of $299 billion.