6. International arms transfers

Overview, Siemon T. Wezeman

I. Global trends in arms transfers, 2019–23, Siemon T. Wezeman, Katarina Djokic, Mathew George, Zain Hussain and Pieter D. Wezeman

II. Developments among the suppliers of major arms, 2019–23, Siemon T. Wezeman, Katarina Djokic, Mathew George, Zain Hussain and Pieter D. Wezeman

III. Developments among the recipients of major arms, 2019–23, Siemon T. Wezeman, Katarina Djokic, Mathew George, Zain Hussain and Pieter D. Wezeman

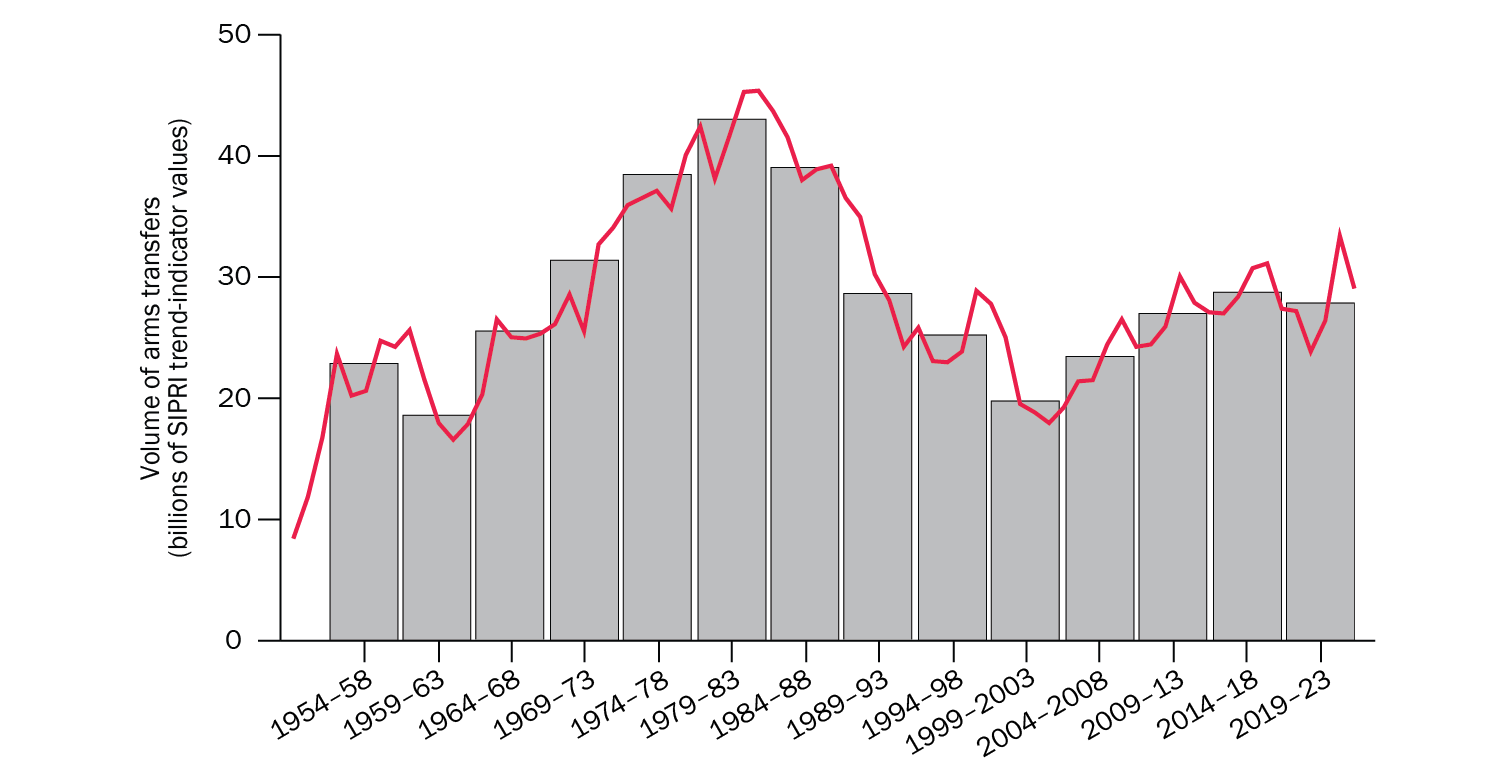

The volume of international transfers of major arms in the five-year period 2019–23 was 3.3 per cent lower than in 2014–18 but 3.2 per cent higher than in 2009–13. The volumes of arms transfers in these periods were among the highest since the end of the cold war, but were still around 35 per cent lower than the peak periods for arms transfers during the cold war.

States’ arms acquisitions, often from foreign suppliers, are largely driven by armed conflict and political tensions. With these drivers increasing in most regions—notably in Europe—continued or higher demand for major arms will likely be fulfilled in the coming years mainly by international transfers. Long-range land-attack weapons, including advanced combat aircraft and missiles, as well as much simpler and cheaper armed uncrewed aircraft and missiles, continue to account for a significant share of total transfers of major arms.

The trend in transfers of major arms, 1954–2023

Note: The bar graph shows the average annual volume of arms transfers for 5-year periods and the line graph shows the annual totals.

Suppliers of major arms

SIPRI has identified 66 states as exporters of major arms in 2019–23, but most are minor exporters. The 25 largest suppliers accounted for 98 per cent of the total volume of exports, and the top 5—the United States, France, Russia, China and Germany—accounted for 75 per cent. In recent years the USA’s share of global exports has increased while Russia’s share has decreased. In 2019–23 the USA’s arms exports were 17 per cent higher than in 2014–18 and its share of the global total increased from 34 to 42 per cent. In contrast, Russia’s arms exports decreased by 53 per cent and its share of the global total dropped from 21 to 11 per cent. Exports by France rose by 47 per cent between 2014–18 and 2019–23, resulting in France becoming the second largest exporter of major arms in 2019–23.

Known plans for future deliveries of major arms strongly indicate that the USA will remain unchallenged as the largest arms exporter in the coming years and that France will consolidate its position in second place. They also indicate that Russia’s arms exports may well reduce even further, while those of some of the other current top 10 exporters are likely to remain steady or increase.

Recipients of major arms

SIPRI has identified 170 states as importers of major arms in 2019–23. The five largest arms importers were India, Saudi Arabia, Qatar, Ukraine and Pakistan, which together accounted for 35 per cent of total arms imports. The region that received the largest volumes of major arms in 2019–23 was Asia and Oceania, accounting for 37 per cent of the total, followed by the Middle East (30 per cent), Europe (21 per cent), the Americas (5.7 per cent) and Africa (4.3 per cent). Between 2014–18 and 2019–23, the flow of arms to Europe increased by 94 per cent, while flows to all other geographical regions decreased: Africa (−52 per cent), Asia and Oceania (−12 per cent), the Middle East (−12 per cent) and the Americas (−7.2 per cent).

Many of the 170 importers are directly involved in armed conflict or in tensions with other states in which the imported major arms play an important role. Moreover, many of the exporters are direct stakeholders or participants in at least some of these conflicts and tensions, which partly explains why they are willing to supply arms, even when the supply seems to contradict their stated arms export policies. It is also noteworthy that, for most suppliers, arms exports are only a small part of the financial value of their total exports.

The financial value of states’ arms exports

While SIPRI data on arms transfers does not represent their financial value, many arms-exporting states do publish figures on the financial value of their arms exports. Based on this data, SIPRI estimates that the total value of the global arms trade was at least $138 billion in 2022 (the latest year for which data is available). This is less than 0.5 per cent of the total value of global international trade in 2022.