5. Military expenditure and developments in arms production

Overview, Nan Tian

I. Global developments in military expenditure, 2023, Nan Tian

II. Regional developments in military expenditure, 2023, Nan Tian, Diego Lopes da Silva, Xiao Liang, Lorenzo Scarazzato, Lara Maria G. G. Costa and Noah Heinemann

III. The SIPRI Top 100 arms-producing and military services companies, 2022: Regional and national developments, Xiao Liang, Lorenzo Scarazzato, Lucie Béraud-Sudreau, Nan Tian and Diego Lopes da Silva

IV. The arms industry facing rising demand, Lucie Béraud-Sudreau, Nan Tian, Diego Lopes da Silva and Xiao Liang

Estimated global military expenditure rose for the ninth consecutive year in 2023, to surpass $2.4 trillion, driven by the Russia–Ukraine war and wider geopolitical tensions. Despite the consequent growth in demand for weapons and continued efforts to meet that demand, arms companies have found it difficult to boost production.

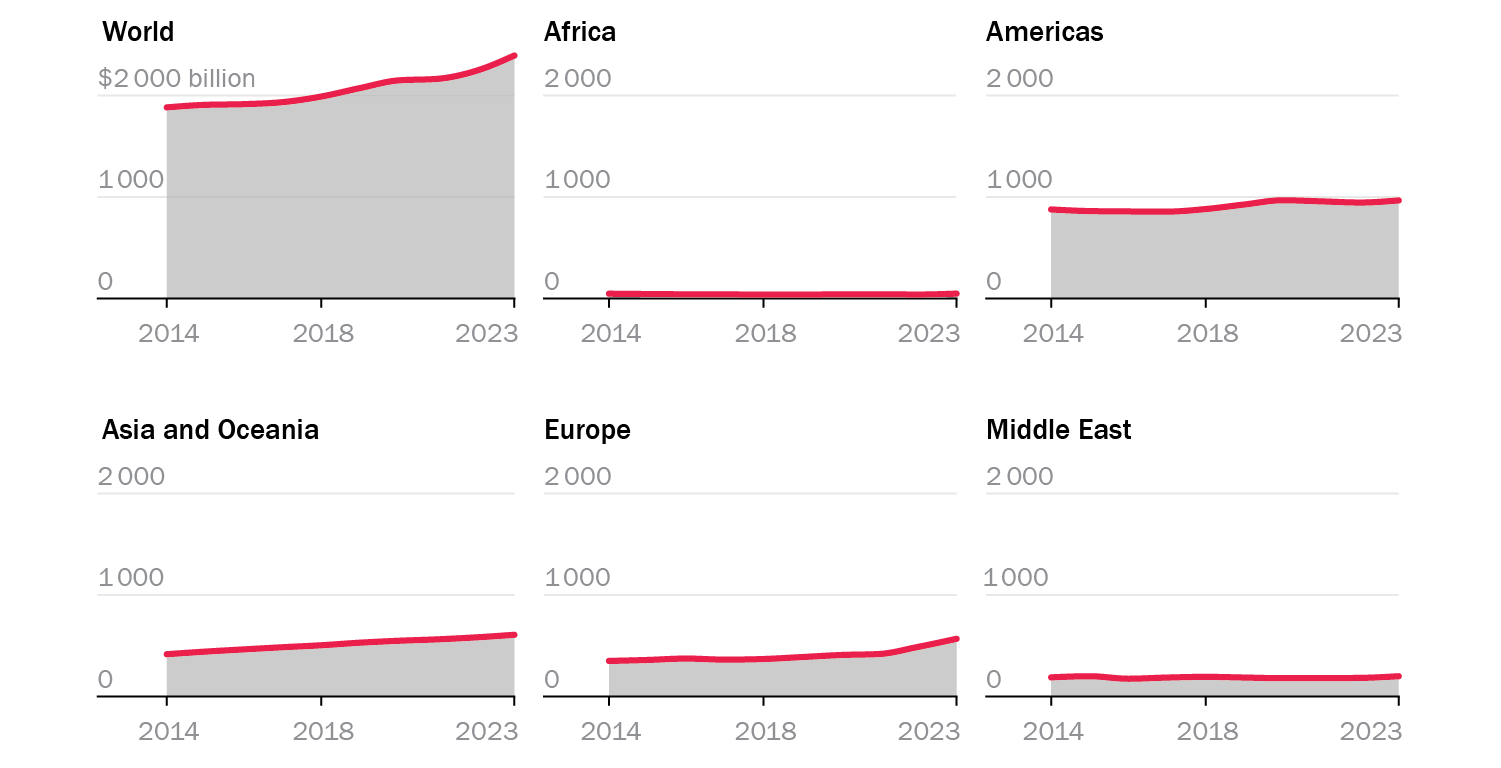

The 6.8 per cent increase in total military spending in 2023 was the largest rise since 2009 and pushed estimated world spending to the highest level recorded by SIPRI. As a result, the global military burden—world military expenditure as a share of world gross domestic product (GDP)—rose to 2.3 per cent. Governments allocated an average of 6.9 per cent of their budgets to the military or $306 per person. Estimated military spending increased across all five geographical regions for the first time since 2009. Spending by countries in Africa rose the most (by 22 per cent in 2023), while the smallest increase was in the Americas (2.2 per cent).

The United States remained by far the largest military spender in the world. The USA’s expenditure of $916 billion was more than the combined spending of the 9 other countries among the top 10 spenders, and 3.1 times as large as that of the second biggest spender, China. The trend for increased military spending by European states in response to Russia’s full-scale invasion of Ukraine gained traction in 2023: 39 of the 43 countries in Europe increased military spending. The 16 per cent surge in total European spending was driven by a 51 per cent rise in Ukrainian spending and a 24 per cent rise in Russian spending, as well as by 10 of the 28 European members of the North Atlantic Treaty Organization (NATO) reaching or surpassing the 2 per cent of GDP spending target in 2023—the highest number since the target was set in 2014.

In Asia and Oceania estimated military expenditure rose for the 34th consecutive year. Half of the regional total consisted of spending by China, which rose by 6.0 per cent to reach $296 billion in 2023. China’s spending influenced spending decisions in neighbouring countries and the broader region: in Japan, for example, spending rose by 11 per cent, the largest year-on-year spending increase since 1972.

Estimated military spending in the Middle East grew by 9.0 per cent in 2023, with increases in all three of the biggest spenders in the region: Saudi Arabia, Israel and Türkiye. The Israel–Hamas war was the main driver for the 24 per cent increase in Israel’s military expenditure.

Military expenditure by region, 2014–23

Note: Figures are in constant (2022) US$ billion.

The SIPRI Top 100

The arms revenues of the 100 largest

arms-producing and military services companies—the SIPRI Top 100—fell by 3.5 per cent in 2022 (the most recent year for which data is available), to reach $597 billion. This fall was mainly the result of overall decreases in the arms revenues of companies in the USA and Russia, but the USA continued to dominate the ranking with 42 companies with combined arms revenues of $302 billion. Due to a lack of available data, only two Russian companies were included in the Top 100 for 2022, with combined arms revenues of $20.8 billion, which was 12 per cent lower than in 2021. This decrease may have been due to delayed payments for arms deliveries and companies focusing on refurbishment instead of new production.

The impact of the Russia–Ukraine war on arms production

Despite Western sanctions and trade restrictions, Russia has still been able to import components (e.g. microchips) to increase its arms production in response to increased demand. For components that Russia could not source indirectly from the West, it relied on Chinese alternatives. To meet its war requirements, Ukraine entered into international collaborations with European and US companies.

The overall imbalance between the increase in demand for weapons and falling arms revenue of the Top 100 highlights the lengthy time lag between the initial demand for weapons and the subsequent scaling up of production and delivery by arms companies. Whereas European and US companies have struggled to translate higher demand into revenue, many companies in Asia and the Middle East—such as those in South Korea and Türkiye—seemed to overcome these challenges.